Donald Trump's Vancouver visit next week confirms speculation about tower

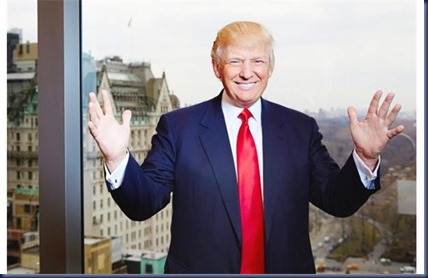

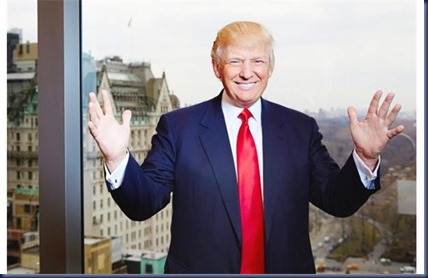

VANCOUVER -- Donald Trump is coming to Vancouver next week, confirming speculation that the Holborn Group will be bringing a Trump International tower to the city.

The Holborn Group wouldn’t elaborate on the announcement, saying only that the iconic Manhattan developer is bringing his family — including son Donald and daughter Ivanka — to a news conference Wednesday to announce details of what is described as “one of Vancouver’s most iconic buildings.”

But branding expert Steven Kates isn’t convinced Vancouverites have an appetite for Trump and everything he represents.

Kates, a professor at Simon Fraser University’s Beedie School of Business, said the man seen by some as “the public face of capitalism” may have soured many Canadians on his brand.

“On the one hand he is quite a divisive figure, especially with his antics during the presidential campaign of last year questioning whether President Obama was in fact born in the U.S. — that borders on ‘crazy town,’” said Kates. “Canadians don’t go for that, they think it’s absurd.

“On the other hand, there may be a small target segment of consumers who just don’t care about that and believe the Trump brand is associated with top luxury and opulence.”

Thursday’s announcement follows media reports earlier this year that a deal was close for a Trump Tower on the site of the cancelled Ritz-Carlton hotel-condo project, which was designed by Arthur Erickson as a twisting 60-storey tower that would have been Vancouver’s second tallest building.

The Ritz-Carlton project, on Georgia between Bute and Thurlow, was cancelled in 2009 because “worldwide economic turmoil” affected the sale of units in the project, a letter from Holborn’s lawyers stated at the time.

At the time of the 2009 cancellation, Holborn had sold about 62 of the 123 condos in the tower, where prices ranged from $1.4 million to $28 million. A 127-room luxury Ritz-Carlton hotel was supposed to occupy the first 20 floors of the building, with condos taking up the top 40 floors. Construction was halted at the site in 2008.

Real estate marketing and consulting groups said Thursday they believe there is room for another luxury condo highrise in Vancouver, although price points will be very important.

Although Holborn wouldn’t comment on their plans, Jon Bennest, principle of Vancouver-based real estate and urban planning consulting company Urban Analytics, said there’s widespread belief that the units in a redesigned building bearing the Trump brand would be slightly smaller and possibly slightly less extravagant than what was originally planned for the Ritz-Carlton project.

There are several other hotel-condo projects in Vancouver, including the Shangri-La, which was completed in 2009 and is Vancouver’s tallest building at 62 storeys.

“I think there’s a potential demand for (luxury condos),” said Bennest. “A lot of people on the west side of Vancouver who want to stay in the area want to sell their single family home and have some money left over.

“The idea is that the product would be luxurious, but at a lower overall price point so they could attract a larger pool of buyers. That is anecdotally what we’ve heard is the direction of the building. And their intention is to make the units slightly smaller than the previous offering.”

Scott Brown, senior vice-president, Colliers International’s project marketing group, said that although he’s never sold a Trump building, he’s sold several other top brands including Four Seasons Hotels, Raffles Singapore, Westin Hotels and Resorts, and Hard Rock Hotels.

“Generally, a market associated with these brands do bring a premium,” said Brown. “However, since 2008, the premium those brands could fetch has not been as high. They (Holborn) should get some premium, it’s a question as to how much.”

“It will be interesting what the Asian response is to the Trump brand.”

Holborn Group bought the West Georgia property from Cadillac Fairview about eight years ago and demolished a partly built concrete structure that had sat derelict for years, after failed attempts to build a private members’ club and a strata-title office building.

In February, Amanda Miller, Trump’s vice-president of marketing, said members from the Trump Hotel Collection development team had recently visited Vancouver looking at various opportunities in the market. “It is a great city with tremendous access to the Asian market and we look forward to continuing to explore the potential of bringing the Trump flag to this location.”

Holborn president and CEO Joo Kim Tiah said Thursday in an emailed response to a request for an interview: “We look forward to sharing more details with you next week.”

Roxanne Reid, president of Hestia Marketing Group Inc. in Vancouver, was senior vice-president of marketing for S & P Destination Properties when she oversaw the marketing of the Trump International Waikiki Hotel project in Hawaii in 2006, which she said had a one-day sellout of $700 million.

She said the Trump brand brings an international appeal. “The Trump brand is synonymous with high service and quality. It’s pure luxury, although not ostentatious. It’s a more refined luxury.”

She also noted that Ivanka Trump has taken a real lead in the brand “and has a good following on an international basis.”

Kevin McNaney, assistant director, central area planning for the city of Vancouver, said Thursday that the city has had a development permit in place on the site since November 2011 for a 64-storey hotel/residential tower. “The building is under construction,” he added, in an emailed statement. “The only thing not known is the hotel brand.”

Talon International, the Toronto developer of the Trump tower in that city, is facing a multimillion-dollar lawsuit from a group of investors, who allege that they were targeted by “an investment scheme and conspiracy based upon reckless and negligent misrepresentations” of the luxury hotel’s financial prospects, the National Post reported in 2012.

Talon directors maintained that they delivered what they promised in the five-star hotel, which rises 65 storeys at the corner of Bay and Adelaide streets.

In their 54-page lawsuit, which also names Donald Trump as a defendant, the four plaintiffs seek to recoup hundreds of thousands of dollars in deposits, along with more than $2.5 million apiece in general damages for “loss of opportunity and consequential damages, negligent misrepresentation and conspiracy.”

The statement of claim says the plaintiffs had limited or no experience investing in real-estate when they opted to purchase hotel units in the Trump tower, which is divided at the 32nd floor between residential and hotel space.

© Copyright (c) The Vancouver Sun