In a report earlier this year, Royal Bank of Canada chief economist Craig Wright suggested home ownership for a growing number of Canadians has become an impossible dream. That’s certainly true in Vancouver, where the affordability index is at record highs, with the average home price at nearly 10 times the median income.

But perhaps ownership has been oversold as an aspirational goal. As thousands of Americans have discovered, sometimes the dream becomes a nightmare.

In the United States, home ownership wasn’t just a dream, it was held up as an inalienable right. Washington pressured financial institutions to lend money to almost anyone who asked, giving rise to the NINJA mortgage (no income, no job, no assets).

Because mortgage interest was (and still is) tax deductible, homeowners did not bear the full burden of borrowing. Financial institutions turned to the wizards of Wall Street to devise derivatives that might mitigate the heightened risk.

The U.S. government had already sanctioned mortgage-based securities, having set up the Government National Mortgage Association (Ginnie Mae) in 1968 and the Federal Home Loan Mortgage Corp. (Freddie Mac) in 1970 to expand the secondary market for mortgages.

Inevitably, homeowners without the means to repay their debts defaulted on their mortgages and the derivatives based on them, including mortgage-backed securities and collateralized debt obligations, became worthless. Not knowing the extent of exposure to toxic debt, financial institutions became reluctant to lend to each other.

The result was a credit crisis that plunged much of the world into recession.

The housing crash that crippled the U.S. didn’t happen in Canada for several reasons. For a start, more prudent lending practices prevented the emergence of a significant subprime mortgage market. Canada’s regulatory regime acted as a rudder that kept the financial services industry on an even keel. And besides the capital gains exemption on the sale of a principal residence, there is no particular tax advantage in owning a home in Canada.

Measures mistakenly introduced to loosen mortgage lending rules — such as interest-only loans and 40-year amortizations — were quickly reversed, forestalling a flood of overly leveraged households.

However, while Canada doesn’t idealize home ownership to the extent the U.S. does, it is still perceived as preferable to renting. Owning is seen as permanent, renting transient, the implication being that ownership contributes more to community stability.

Owners are thought to be more involved in community activities than renters, adding to social cohesion. The pride of ownership is viewed as a motivator for owners to maintain their properties, while renters supposedly lack this incentive. There is scant research to support any of these contentions.

In any case, Canadians have pursued the holy grail of home ownership with as much zeal as their American cousins and have achieved similar rates of both ownership and indebtedness.

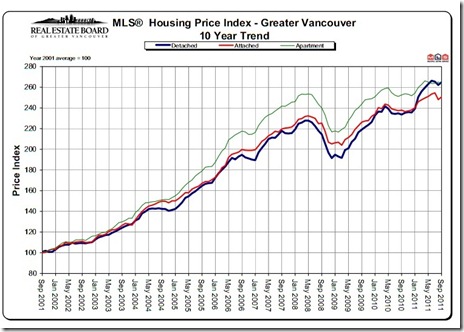

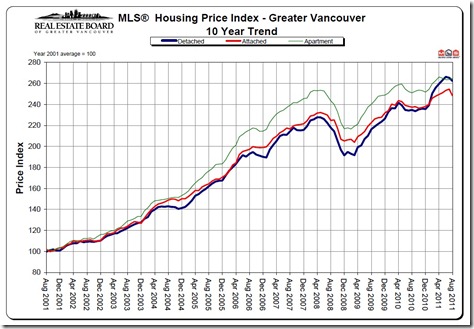

Canadian households, on average, now carry nearly $1.50 of debt for every dollar of income. Most of that debt is mortgage debt. Historically low interest rates have enticed buyers to get into the real estate market or to upgrade to more expensive homes. That, along with increasing real estate investment from outside Canada, especially from mainland China, has driven home prices in B.C. to record levels.

Overpriced

Vancouver lays claim to the highest median house prices in Canada and Forbes magazine ranks the city’s real estate market as the sixth most overpriced in the world. (Forbes calculated an annualized rate of return on property based on cash flows from renting, then flipped the result to produce the equivalent of a price-to-earnings ratio. Vancouver’s was 26.8; Monaco was No. 1 at 74.1.)

Each quarter RBC publishes an affordability index that examines the cost of ownership relative to household income. Most recently, it found the cost of mortgage payments, utilities and property taxes for a detached bungalow in Vancouver amounted to 92.5 per cent of a typical household’s monthly income.

“Vancouver’s housing market is without a doubt the most stressed in Canada and is facing the highest risk of a downturn,” Wright said in the affordability report.

That real estate in Vancouver is expensive is not news.

A 2008 study by Tsur Somerville, professor of real estate finance at the Sauder School of Business at the University of British Columbia, and his research assistant, Kitson Swann, determined that house prices in Vancouver would have to fall by 11 per cent to be in balance with rents; in other words, for the price-to-rent ratio to be in equilibrium.

The study assumes that the housing market is in equilibrium when the ratio of house rents to prices equals the sum of mortgage rates and cost of holding a house minus the expected long-run rate of price appreciation. House prices above their equilibrium level doesn’t guarantee they will fall, the study says. But the potential for decline is greatest in cities that have built more units than can be absorbed by the growth in households.

“Recent data,” it adds, “suggests that Vancouver is most at risk in this regard.”

A two-bedroom-plus-den, two-bathroom, 1,500-square-foot townhouse in North Vancouver was recently listed for rent at $2,200 a month. Another townhouse of similar size in the same complex was offered for sale at $649,900. The price to rent ratio of 24.6 suggests that either the property is overvalued or the rent is too low. Trulia.com, a U.S. real estate website, says a ratio of 21 or more means it’s better to rent than to buy.

Analyze this data as an investor would by dividing the annual rent by the capital cost of the property and the return — or rental yield — is 4.1 per cent. With Government of Canada benchmark bond yields trending below three per cent, an investor might consider this an adequate ROI. But mortgage payments with 25 per cent down, a 25-year amortization and a variable interest rate of three per cent would amount to roughly $2,300, which turns this into a losing proposition, even before taxes and maintenance expenses.

According to Forbes magazine, “the relationship between rental yields and housing costs matters because a low rental yield is a good indication of a stretched market — one that has a bubble — since these markets are more likely to face downward price pressures or grow at a slower rate.”

Based on the numbers then, one might draw the conclusion that Vancouver is a real estate bubble. But bubbles don’t always burst; sometimes they slowly deflate. A few analysts believe that fate awaits Vancouver.

TD Bank, for instance, forecast this summer that average house prices in Metro Vancouver will decline by 14.8 per cent by the end of 2013, but will still be worth more than they were in 2010.

A place to call home

Would-be buyers and renters can while away hours by Googling the term “buy or rent calculator” and working through various scenarios.

However, the majority of home buyers aren’t thinking about the return on investment on an asset, they’re looking for a place to raise a family, close to schools and shopping, maybe with a yard, a deck for the barbecue and a basketball hoop on the garage: a place to call home.

These misty-eyed buyers might do better than you imagine.

Consider that North Vancouver listing with the high price-to-rent ratio and low yield. If they were to rent at $2,200 a month with annual rent increases of two per cent, they’d pay $289,072 over 10 years.

If they could come up with $162,500 (for 25 per cent down) and borrow $480,000 at today’s historically low rate of three per cent (and pay $900 a year on upkeep), they’d pay $281,589.

If the house appreciated by seven per cent a year and the cost of selling it was seven per cent, the appreciation value would be $1,278,451. They’d come out ahead by $867,080.

It would take a savvy investor to beat that under current stock, bond, currency or commodity market conditions. At the same time, it is risky to have so much capital tied up in a single immovable and relatively illiquid asset.

In the final analysis, whether it is better to buy or to rent depends not so much on interest rates and ratios but rather on an individual’s goals in life. For some, home ownership is a ball and chain; for others, it is fulfillment of a dream.

Odds are that if you’re asking the question, you’ve already made up your mind.

© Copyright (c) The Vancouver Sun