Economic conditions and new laws supporting strong housing sector, CMHC says

Canada's national housing agency says it expects the country's real estate industry will remain healthy in the second half of the year, building on favourable economic conditions in the first six months of 2011.

Canada Mortgage and Housing Corp. said Monday that there have been fewer claims under its mortgage insurance programs, which protect lenders from defaults by borrowers.

CMHC attributed the reduced number of claims to continued low interest rates and an improved employment situation.

The agency said it expected fixed mortgage rates to stay relatively flat for most of the year, with the five-year posted rate at between 4.1 per cent and 5.6 per cent, then increase slightly in 2012.

CMHC said variable rate mortgages would remain near historically low levels, although some banks recently increased their variable rates to reflect the higher cost of raising money.

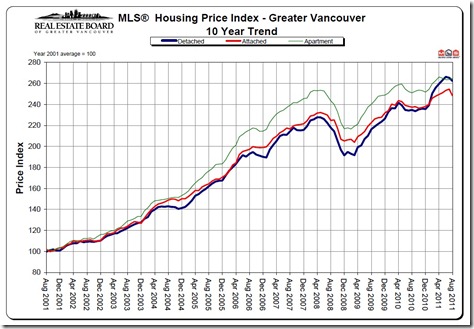

Prices of homes shown on the Multiple Listing Service are expected to grow only slightly going forward because the supply and demand for resale homes will likely stay in balanced territory, CMHC said.

A least one analyst agreed that the real estate market should stay fairly healthy for the rest of 2011, but said it's already cooling slowly and home prices may decline in the longer term.

"What you're probably looking at is a period where prices are relatively flat, maybe a little bit lower in the next few years," said Adrienne Warren, an economist at Scotiabank who specializes in the real estate industry.

"Affordability from a price perspective has deteriorated and that's going to have to, over time, come back to more normal levels but it doesn't imply that that has to happen quickly as a type of correction that occurs quickly."

She said interest rates are low and attractive right now and encourage first time home buyers to enter the market, which drives up prices. Once those rates begin to rise — likely in the second half of 2012 — the current price of homes will become unaffordable for many, putting downward pressure on future prices.

Meanwhile in its report Monday, CMHC said changes to mortgage rules introduced by the federal government earlier this year played a part in reducing mortgage interest payments and allowed Canadians to build equity in their homes faster.

Canadians are finding it easier to pay off their mortgages, with arrears levels improving and the volume of mortgage insurance claims lower than expected.

In March, the federal government put through new rules that reduced the maximum amortization period to 30 years and cut the maximum amount Canadians can borrow to 85 per cent of the home's value.

After the changes, refinancing activity fell by nearly 40 per cent, which means fewer Canadians took on more debt. Federal Finance Minister Jim Flaherty and Bank of Canada governor Mark Carney have repeatedly warned of the ballooning debt level of Canadian consumers.

Ten per cent fewer Canadians bought mortgage insurance immediately after the new rules began, and the level was five per cent lower than sales before the changes came into effect.

CMHC reported its net income for the quarter was $383 million, up $61 million from $322 million in the same quarter last year. Revenues were down slightly at $3.3 billion, versus $3.4 billion.

The agency's predictions for the rest of the year echo a revised forecast by the Canadian Real Estate Association released earlier this month. CREA said it expected higher national home resales this year, reversing upward its previous forecast of a one per cent dip.

National average prices will be in the range of $347,700 to $374,300, growing to between $349,500 to $385,000 in 2012, CREA predicted.

CMHC said sales of existing homes should range between 429,500 and 480,000 units in 2011 and between 410,000 and 511,900 units in 2012.

Earlier this month, the CMHC said that national housing starts rose to 205,100 units on a seasonally adjusted basis in July, 11.6 per cent higher than the 188,900 reported in the same month last year and 4.3 per cent more than the 196,600 recorded in June.

The uptick, driven by strong construction on condos and apartment buildings in urban centres, is likely due to builders catching up to robust demand last year rather than expectations of coming growth, it said.

Home building activity has been increasing through the first seven months of 2011, but starts are still down 4.6 per cent from a year ago.

Predictions for the Canadian market were in stark contrast with the most recent figures from the United States, which showed that country's depressed housing market is still trying to get back on track.

The U.S. National Association of Realtors said Monday that its index of sales agreements fell 1.3 per cent in July to a reading of 89.7. A reading of 100 is considered healthy by economists

The association also said a growing number of buyers had cancelled contracts after appraisals showed the homes they wanted to buy were worth less than they bid.

By Mary Gazze, The Canadian Press

Cat: Vancouver Real Estate