General price declines in B.C. make province 'nation's new weak spot,' according to report

Canada's housing market is not a bubble, it's a balloon. And unlike the catastrophic decline the U.S. housing market experienced in 2008, the market in Canada will deflate slowly rather than pop, according to a report by BMO Capital Markets.

The sole possible exception is Vancouver, where the number of unoccupied condominiums is high due to building the Olympic Village, economists Sherry Cooper and Sal Guatieri wrote in "Will Canada's Housing Boom Forge On, Fizzle Out, or Flame Out?"

But generally, the report says that despite rising household debt, low interest rates and rising home prices, it is unlikely that a sudden correction will take place.

"The main take-away is that the national housing market appears some-what pricey, but is far removed from bubble territory," the report stated.

It compares average resale prices with median family incomes and finds the ratio is 4.9 nationally, compared to 3.2 a decade ago.

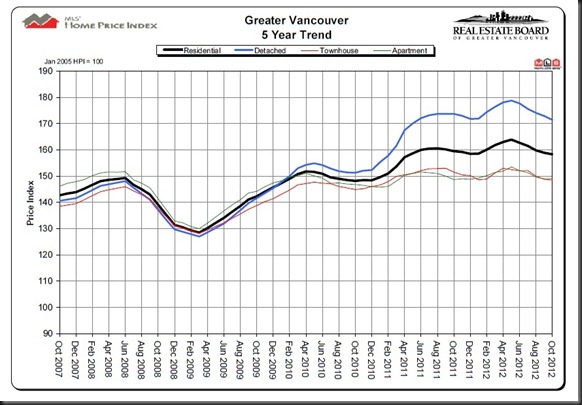

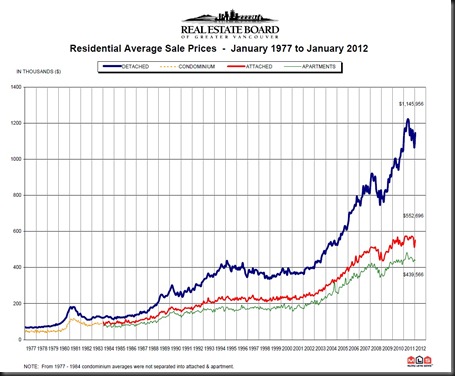

In Vancouver, though, where house prices have gone up 159 per cent in the last 10 years - compared to 104 per cent nationally - the ratio of price to income is 10, nearly double what it was a decade ago, the report said. Victoria is also high, at 5.7, but not as high as Toronto, which has a price to income ratio of 6.7.

Montreal has also seen prices rise dramatically - by 153 per cent - and its price-to-income ratio double, but that ratio remains low at 4.5.

Despite rising home prices in most of Canada's major cities, the growth doesn't seem to be excessive, the report said. But elevated valuations could lead to trouble in the event of a shock.

For example, if interest rates were to spike by about four percentage points, the affordability of homes would quickly drop throughout the country. A severe recession would also affect affordability.

But the chance of either of those events happening is unlikely, the report authors stated. Also, except for a few markets, the national housing boom has already cooled.

And British Columbia is now "the nation's new weak spot, with prices generally declining," the report said.

Some of that decline reflects fewer sales of high-end homes.

"[But] some real underlying softness is at play, and will likely continue until valuations improve," the report stated.

Tsur Somerville, director for the Centre for Urban Economics and Real Estate at the Sauder School of Business at UBC, said BMO's report is one of many predicting slight drops or slight increases in the housing market rather than a major correction.

"The kinds of things you need to get major corrections, like oversupply or radical change in the financing environment, just aren't there," Somerville said.

And just because the overall market will be flat, it doesn't mean that certain portions of it - such as areas that have had higher run-ups in prices over the past few years - aren't in for a correction, he said.

Helmut Pastrick, chief economist with Central 1 Credit Union, believes that while there may be a soft landing at some point in the future, it won't be in 2012.

"The market is holding up generally well and it looks like 2012 is going to be fairly similar to 2011 in terms of overall unit sales," Pastrick said. "Housing prices will go up by some amount, sales will also increase by a small amount."

And while the economy isn't booming, it is growing, interest rates are low and there is job growth, he said.

"So the conditions to me aren't ripe for a correction."

Meanwhile, Bloomberg reported that Canada's banking regulator fears that Canadian lenders are loosening standards on mortgages that are similar to U.S. subprime loans, posing an "emerging risk" to financial institutions.

Banks and other lenders are becoming "increasingly liberal" with mort-gages and home-equity credit lines that don't require individuals to prove their income, according to documents obtained by Bloomberg under freedom of information law request from the Office of the Superintendent of Financial Institutions.

"Non-income qualified" lending has been added to a list of issues to be considered by OSFI's "emerging-risk committee," Bloomberg reported the documents showing.

Pastrick disputes this finding.

"We're not subprime, not by a long shot," he said.

Lenders in Canada have "credible lending criteria and standards." And while lenders will lower rates to grab market share "credit isn't easy like it was in the U.S.," he said.

Somerville believes the problem is with home equity lines of credit which have become more popular over the year and don't always require income verification.

Not only are lines of credit given out without the same level of super-vision or the same standard of care that is applied to mortgages, they are also junior in seniority to mortgages, Somerville said.

With a file from Bloomberg

© Copyright (c) Postmedia News

Picture by:  All rights reserved by JOHN CORVERA

All rights reserved by JOHN CORVERA