VANCOUVER, B.C. – February 6, 2012 – Greater Vancouver home sellers were more active than buyers in January and overall home prices, according to the new MLS® Home Price Index (MLS® HPI), continued to experience more stability and less fluctuation compared to the beginning of 2011.

The Real Estate Board of Greater Vancouver (REBGV) reports that residential property sales in Greater Vancouver reached 1,577 on the Multiple Listing Service® (MLS®) in January 2012.

This represents a 4.9 per cent decrease compared to the 1,658 sales recorded in December 2011, a decrease of 13.3 per cent compared to the 1,819 sales in January 2011 and an 18 per cent decline from the 1,923 home sales in January 2010.

January sales in Greater Vancouver were the second lowest January total in the region since 2002, though only 146 sales below the 10-year average.

“We’re seeing trends emerge in our market that favour buyers, such as increased selection and more stability in pricing compared to this time last year,” Rosario Setticasi, REBGV president said. “Last month’s activity tells us that competition amongst home buyers was reduced in January, which means that individuals looking to purchase a home had more time to do their homework, consult with their REALTOR®, and make a decision.”

New listings for detached, attached and apartment properties in Greater Vancouver totalled 5,756 in January. This represents a 19.9 per cent increase compared to the 4,801 new listings reported in January 2011, and a 253.3 per cent increase compared to the 1,629 new listings reported in December 2011.

Last month’s new listing count was the highest January total in Greater Vancouver since 1995.

The total number of properties currently listed for sale on the Greater Vancouver MLS® is 12,544, a 12.5 per cent increase compared to December 2011 and an increase of 20.2 per cent compared to January 2011.

Today marks the launch of the MLS® Home Price Index (MLS® HPI), the best and purest way of determining price trends in the housing market. The MLS® HPI was pioneered by six founding partners: the real estate boards of Calgary, Fraser Valley, Greater Montreal, Greater Vancouver, and Toronto and the Canadian Real Estate Association. The partners contracted with Altus Group to develop the MLS® HPI which measures home price trends in the five major markets serviced by those boards.

The new index replaces the MLSLink Housing Price Index, which had been used by Greater Vancouver and Fraser Valley REALTORS® since the mid 1990s. MLS® HPI statistics should not be compared with previous MLSLink HPI statistics.

“The MLS® HPI is a national collaboration intended to give the public a more reliable and comprehensive tool to understand home price trends across the country,” Setticasi said.

The MLS® HPI benchmark price for all residential properties in Greater Vancouver currently sits at $660,600, up 5.7 per cent compared to January 2011 and down 0.1 per cent compared to December 2011. The MLS® HPI also tracks home prices across the Lower Mainland.

The benchmark price for all residential properties in the Lower Mainland is $593,300, an increase of 5 per cent compared to January 2011.

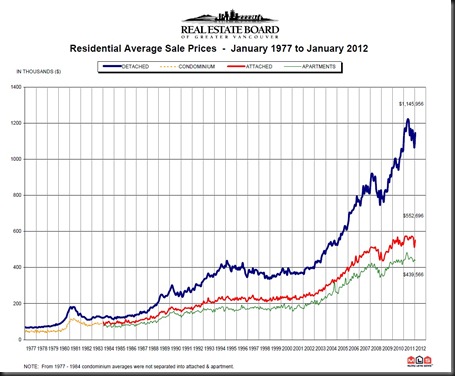

Sales of detached properties on the MLS® in January 2012 reached 659, a decline of 16.9 per cent from the 793 detached sales recorded in January 2011, and a 6.5 per cent decrease from the 705 units sold in January 2010. The benchmark price for detached properties increased 11.3 per cent from January 2011 to $1,034,700.

Sales of apartment properties reached 657 in January 2012, a decline of 7.9 per cent compared to the 713 sales in January 2011, and a decrease of 26.3 per cent compared to the 891 sales in January 2010.The benchmark price of an apartment property increased 2.4 per cent from January

2011 to $371,500.

Attached property sales in January 2012 totalled 261, a decline of 16.6 per cent compared to the 313 sales in January 2011, and a 20.2 per cent decrease from the 327 attached properties sold in January 2010. The benchmark price of a townhome unit declined 0.5 per cent between January 2011 and 2012 to $468,000.

Cat: Greater Vancouver Real Estate